Non-Farm Payrolls

05.06.2020

On Friday 5th of June at 4.30 PM Local UAE time, the markets will be eagerly awaiting the release of this Month’s edition of the Non-Farm Payrolls report. The expectation for this time is for the US economy to have lost 8000K jobs (down from - 20500), with an increase in the unemployment rate from 14.7% to 19.5%.

As of late, the US Stock Market has been rallying and ignoring the current cyclone of negative News from the Coronavirus as well as the US domestic riots and showing a lot of strength, thanks to the stimulus packages rolled out by the Fed and other central

banks. However, The USD has been performing badly in last week’s trading sessions, which makes this NFP number a little more important than usual. The US Stock Market has also somewhat stalled recently and is not rallying with

lots of confidence.

Now that the US Stock market has made a sizeable recovery, the drop in the US Dollar at a time of domestic and international tensions could be a signal that Traders have started to look away from the stimulus packages

and are now focusing on other market fundamentals.

Despite the projection that the 8 million jobs lost in May 2020 are an improvement from the 20.5 million job losses of April 2020, the numbers still do not look great considering the various recent cash injections already

created by the Fed.

Projections

For the NFP numbers to be tradable on several USD pairs, we need to see the following scenarios:

Positive for USD and Dow Jones

If we see an improvement in employment change it will have to be accompanied by a lower unemployment rate for the report to be positive for the USD and also Positive for the Dow Jones Industrial Average.

Negative for USD and Dow Jones

Conversely, if we see a falling employment change it should also follow a rising unemployment rate in order to produce a negative impact on the USD. This would also introduce a bearish sentiment to the US Stock market.

If the numbers come out as expected, then that would leave the USD pairs open to the prevailing fundamentals that are already in place currently.

Technical Outlook

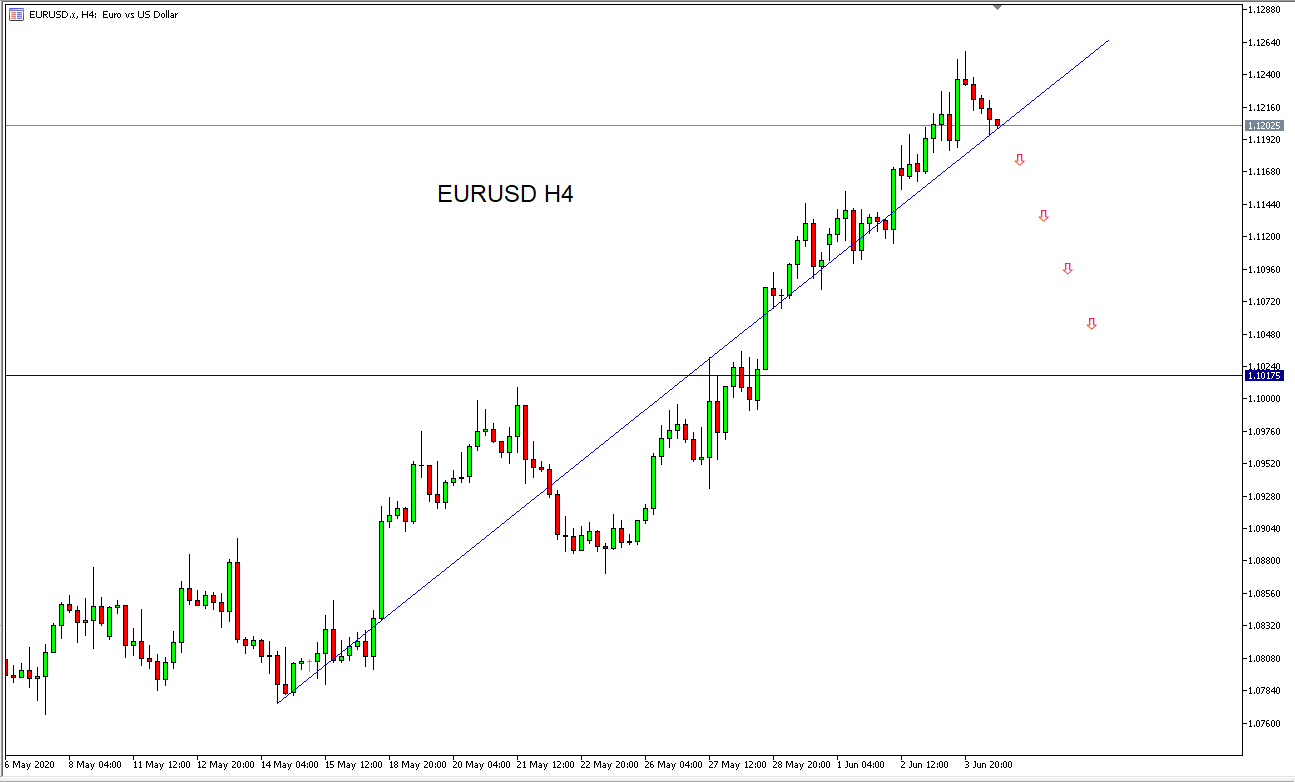

From a technical prospective, the EURUSD is showing weakness against the USD and is close to breaking a trendline on the 4-hour chart to the downside, which if it does break, it would create a downward momentum towards the next key level which is at 1.10175.

Therefore, the most likely scenario for NFP based on the above analysis is a strong US Dollar.

Written by

Shihab Obiedalla